Will never be a knock at the door demanding a huge, snowballed sum of money if you’ve been making low or no repayments.ĭepending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. However, and this is the critical part, the slate is wiped clean in the end there

Of course, interest still accrues over this time, so any ‘downtime’ where you’re not paying off your loan means that there will be more to repay in the long run. So when you’re not earning - or not earning much - you don’t need to make any loan repayments. In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. How long will it take me to pay off my student loan: UK? British students have a more relaxed, means-tested approach, whilst US students face a harsher system and therefore Whether you really need to concern yourself with overpaying to shrink the debt is dependent on where you studied. Ultimately though, the general rule remains the same: the more you pay towards it, the faster the debt will shrink. The value of your student debt depends on a number of factors: where you studied, when you studied, and how long for. Advertisements How long will it take me to pay off my student loan?

#Calculator paying extra on mortgage how to#

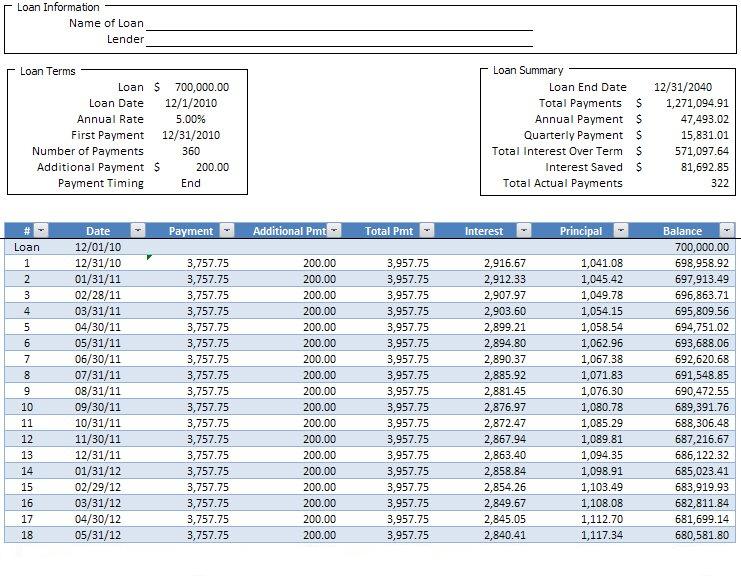

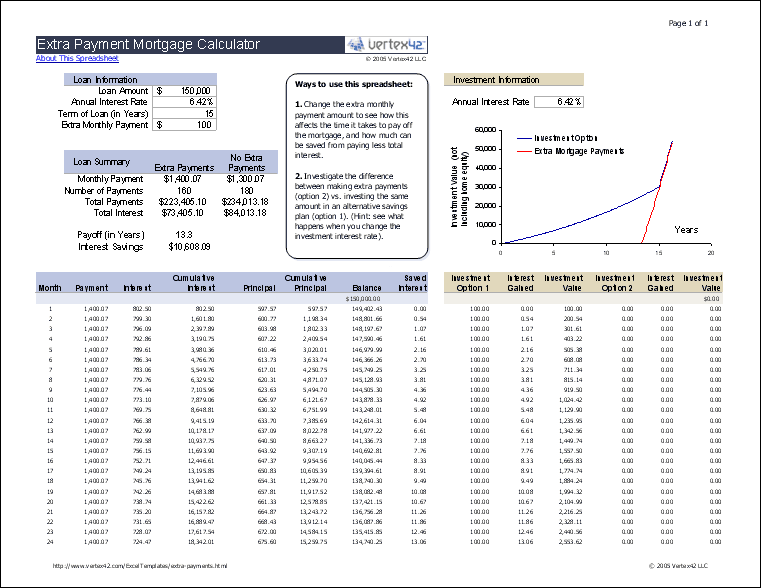

So read on to learn how to shorten and shrink your loan. This next section focuses on the example of student loans, but the tips and advice can apply to all types of loans. You can play around with our Loan Payoff Calculator above, or give our loan calculator a try, to see how overpayments can shorten the length of your loan and reduce the Might only pay $8,856 interest instead of over $13,000. Now, consider this: If your bank allows you to make overpayments and you choose to pay an additional $100 a month, you could find yourself paying your loan off a whole five years earlier.

Payment (in October 2038) you will have paid just over $13,250 in total interest. Using our calculator tools, we can work out that your monthly payment would be $295.88, meaning that by the date of your last loan

Your bank has offered you a loan of $40,000 at an interest rate of 4%, paid back over 15 years. Let's say you're calculating figures for a boat loan. Time is the really important part: the faster you pay back the principal, the lower the interest amount will be. When you repay a loan, you pay back the principal or capital (the original sum borrowed from the bank) as well as interest (the charges applied by the bank for their profit, which grow over time). How long will it take to pay off my loan?

0 kommentar(er)

0 kommentar(er)